TDS, or Tax Deducted at Source, is a tax collection mechanism where the payer deducts a certain percentage of tax from payments made to the payee before handing over the remaining amount. This deducted tax is then remitted to the government. It's designed to ensure tax compliance and prevent tax evasion. A TDS detail report offers a detailed overview of transactions subject to Tax Deducted at Source (TDS), including transaction dates, payer and payee details, transaction amounts, TDS rates, and total TDS deductions. It helps in tracking TDS liabilities, ensuring tax compliance, and facilitating accurate reporting to tax authorities.

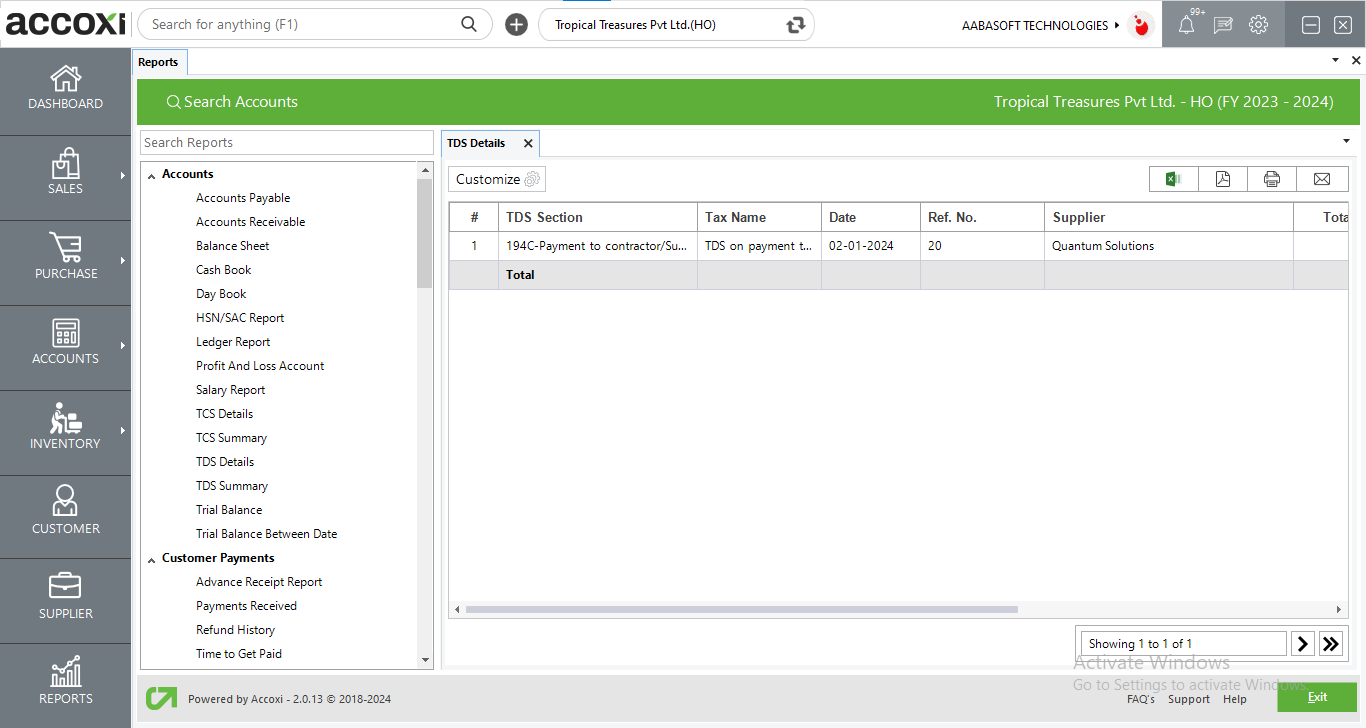

In Accoxi, the TDS detail report offers a breakdown of transactions subjected to Tax Deducted at Source. It provides essential information such as transaction dates, ref no, party details, transaction amounts, applicable TDS section, and the total TDS amounts collected. This report shows transaction wise TDS details. This report aids businesses in managing their TDS obligations, ensuring adherence to tax regulations, and facilitating precise tax reporting within the Accoxi accounting software.

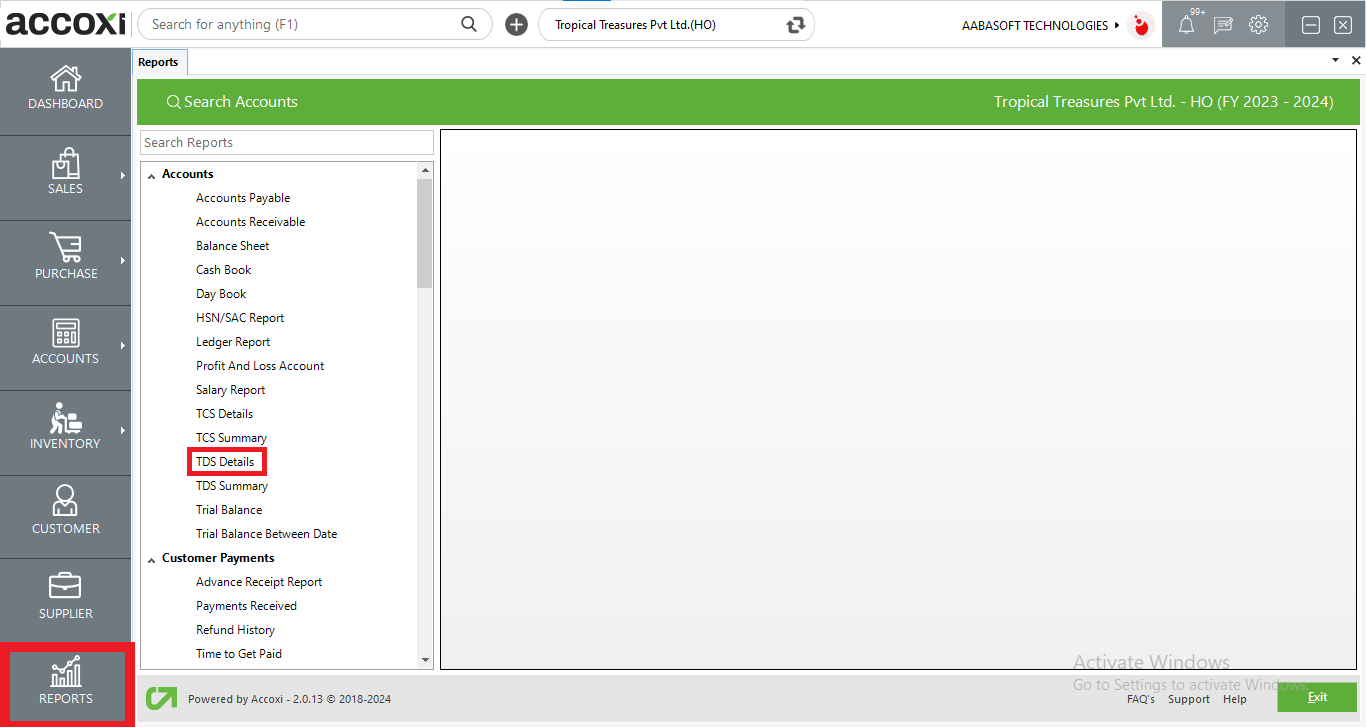

To view the TDS detail report, go to the Accounts section in Report module, select the TDS Details option, and this will prompt the display of the TDS detail report on the screen.

Menu Available in TDS Detail Report

|

Field |

Description |

|

Customize |

The user has the flexibility to tailor the report data by clicking on this button. Data filtration is possible based on date period and TDS section. |

|

Export To Excel |

By clicking this button, users can export the report to excel. |

|

Export To PDF |

Clicking this button allows the user to export the report to pdf. |

|

|

This button enables users to print the TDS detail report. |

|

|

To send the report via email, simply click this button. The report in pdf format will be attached to the email, and you can input the recipient's email address, cc address, subject, and any additional details for the email. |

|

Pagination |

The pagination control offers the capability to navigate from one page to another. |

|

Exit |

Clicking the 'exit' button allows the user to exit from the report. |

Data Available in TDS Detail Report

|

Field |

Description |

|

# |

The Symbol '#' Represents The Number Of Lines In The Given Context. |

|

TDS Section |

This Column Shows The TDS Sections Of The deducted Tax. |

|

Tax Name |

The provided tax name for the applicable section is showing here. |

|

Date |

Date of the transaction is displayed here. |

|

Ref No |

Ref no of the transaction is displayed here. |

|

Supplier |

Supplier involved in the transaction is showing here. |

|

Total Tax Deducted at Source |

Total TDS amount applicable for the transaction is indicated here. |

|

Total After TDS Deduction |

Total invoice amount calculated after considering the TDS amount is showing here. |

|

Total |

Total invoice amount before calculating the TDS amount is showing here. TDS amount is calculated on this amount. |