This report shows all the TCS-related information. It consists of various sections, Total tax collected at source, Total after TCS deduction, etc.

Indian Income Tax act has provisions for tax collection at source. In these provisions, certain persons are required to collect a specified percentage of tax from their buyers on exceptional transactions. Most of these transactions are trading or business in nature. It does not affect the common man. Tax collected at source (TCS) is the tax payable by a seller which he collects from the buyer at the time of sale. Section 206C of the Income-tax act governs the goods on which the seller has to collect tax from the purchasers.

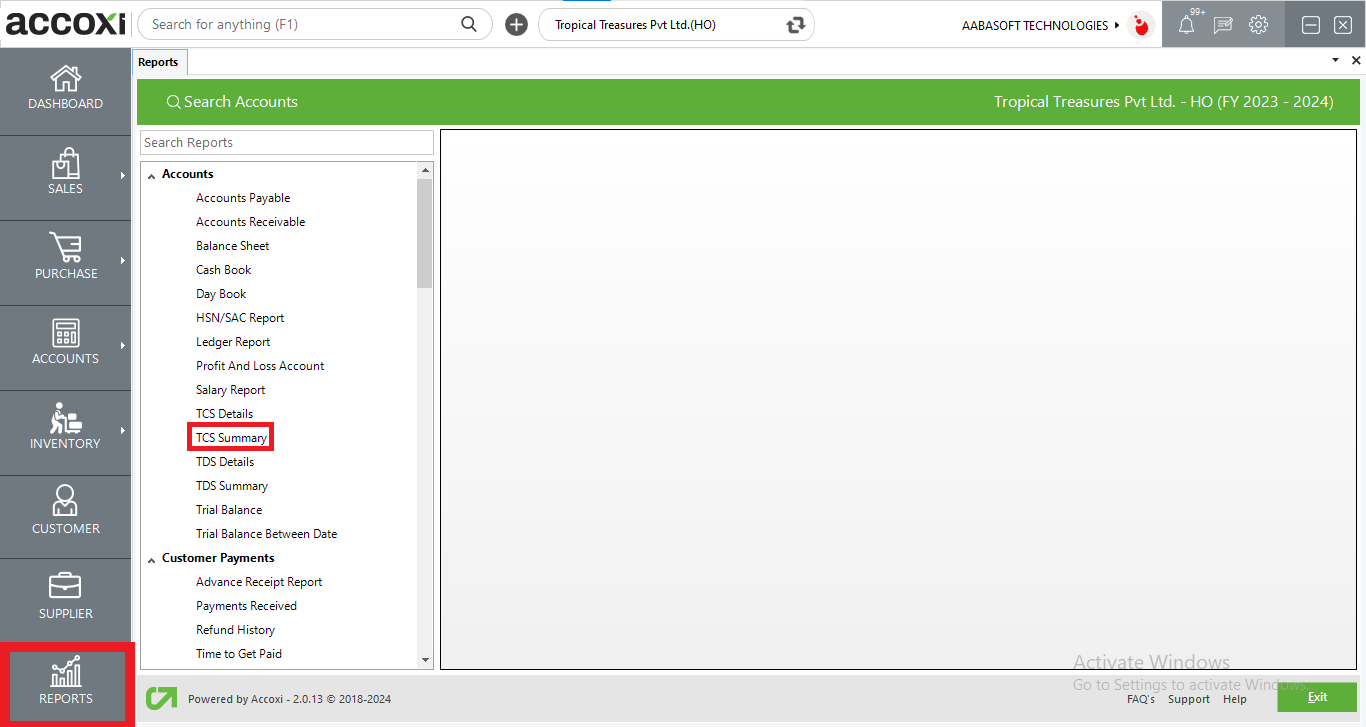

ACCOXI is the most modern accounting software that provides easy and deliberate results for accounting. It provides a separate section of Reports; TCS Summary Report is available under the Accounts Head. This report shows all the TCS-related information. It consists of various sections, Total tax collected at source, Total after TCS deduction, etc. during a particular period. Users can create and manage various TCS sections under the Settings -> TCS Configuration.

To access the TCS Summary Report:

Menu Available in TCS Summary Report

|

Field |

Description |

|

Customize |

The user has the flexibility to tailor the report data by clicking on this button. Data filtration is possible based on date period. |

|

Export To Excel |

By clicking this button, users can export the report to excel. |

|

Export To PDF |

Clicking this button allows the user to export the report to pdf. |

|

|

This button enables users to print the TCS summary report. |

|

|

To send the report via email, simply click this button. The report in pdf format will be attached to the email, and you can input the recipient's email address, cc address, subject, and any additional details for the email. |

|

Pagination |

The pagination control offers the capability to navigate from one page to another. |

|

Exit |

Clicking the 'exit' button allows the user to exit from the report. |

Data Available in TCS Summary Report

|

Field |

Description |

|

# |

The symbol '#' represents the number of lines in the given context. |

|

TCS Section |

This column shows the TCS sections of the collected tax, user can access the TCS section details by clicking on the field. Then the detailed information of the TCS section will appear and it will contain: each transaction wise TCS details. |

|

Total Tax Collected at Source |

Total TCS amount calculated for the section is indicated here. |

|

Total After TCS Deduction |

Total invoice amount calculated after considering the TCS amount is showing here. |

|

Total |

Total invoice amount before calculating the TCS amount is showing here. TCS amount is calculated on this amount. |

ACCOXI is the most modern accounting software that provides easy and deliberate results for accounting. It provides a separate section of Reports, TCS Summary Report is available under the Accounts Head. This report shows all the TCS-related information. It consists of various sections, Total tax collected at source, Total after TCS deduction etc. during a particular period. Users can create and manage various TCS sections under the Settings -> TCS Configuration.

ACCOXI provides the module of Reports and TCS summary report included in it. In the report, customize option helps you to filter the data by a particular date. By clicking on the customize report, you can filter the report by entering the starting date along with the end date, and then the tax details of the transactions will appear on the basis of the date entered.

ACCOXI provides the module of Reports and TCS Summary report included under the Accounts head. The column of Total tax collected at source shows the total amount of tax collected at source under each section. You can access the TCS details by clicking on the field. To check the TCS details of an invoice, click on the Tax Collected at Source section field. While clicking on the field, a new tab will appear with the whole details of TCS.