TCS, or Tax Collected at Source, is a tax levied on certain transactions where the seller collects the tax from the buyer at the time of sale. It's a way for the government to ensure tax compliance and track transactions in specific goods or services. TCS detail report provides a comprehensive breakdown of transactions subject to Tax Collected at Source (TCS). It typically includes information such as the date of the transaction, details of the parties involved (buyer and seller), the amount of the transaction, the rate of TCS applied, and the total TCS amount collected. This report helps businesses track TCS liabilities, ensure compliance with tax regulations, and facilitate accurate reporting to tax authorities. Additionally, it enables businesses to analyze TCS-related transactions for auditing and reconciliation purposes.

In Accoxi, the TCS detail report offers a breakdown of transactions subjected to Tax Collected at Source. It provides essential information such as transaction dates, buyer and seller details, transaction amounts, applicable TCS section, and the total TCS amounts collected. This report shows transaction wise TCS details. This report aids businesses in managing their TCS obligations, ensuring adherence to tax regulations, and facilitating precise tax reporting within the Accoxi accounting software.

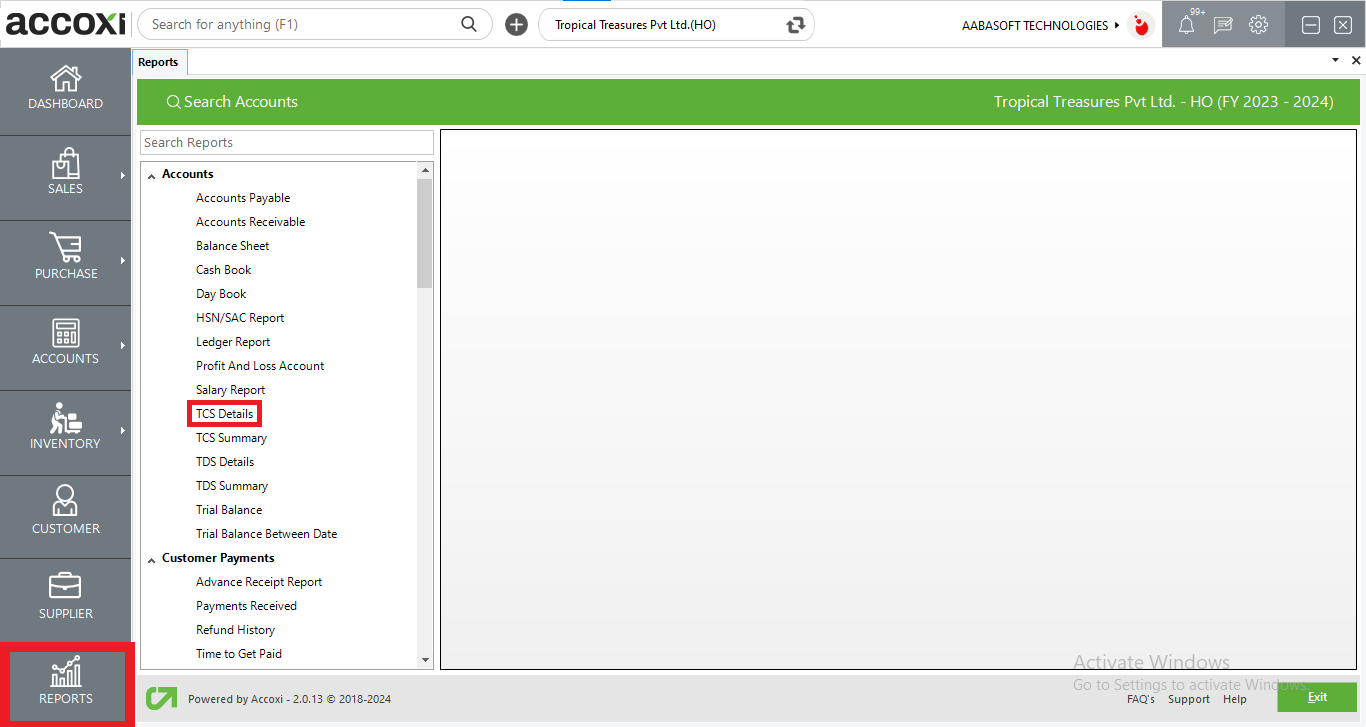

To view the TCS detail report, go to the Accounts section in Report module, select the TCS Details option, and this will prompt the display of the TCS detail report on the screen.

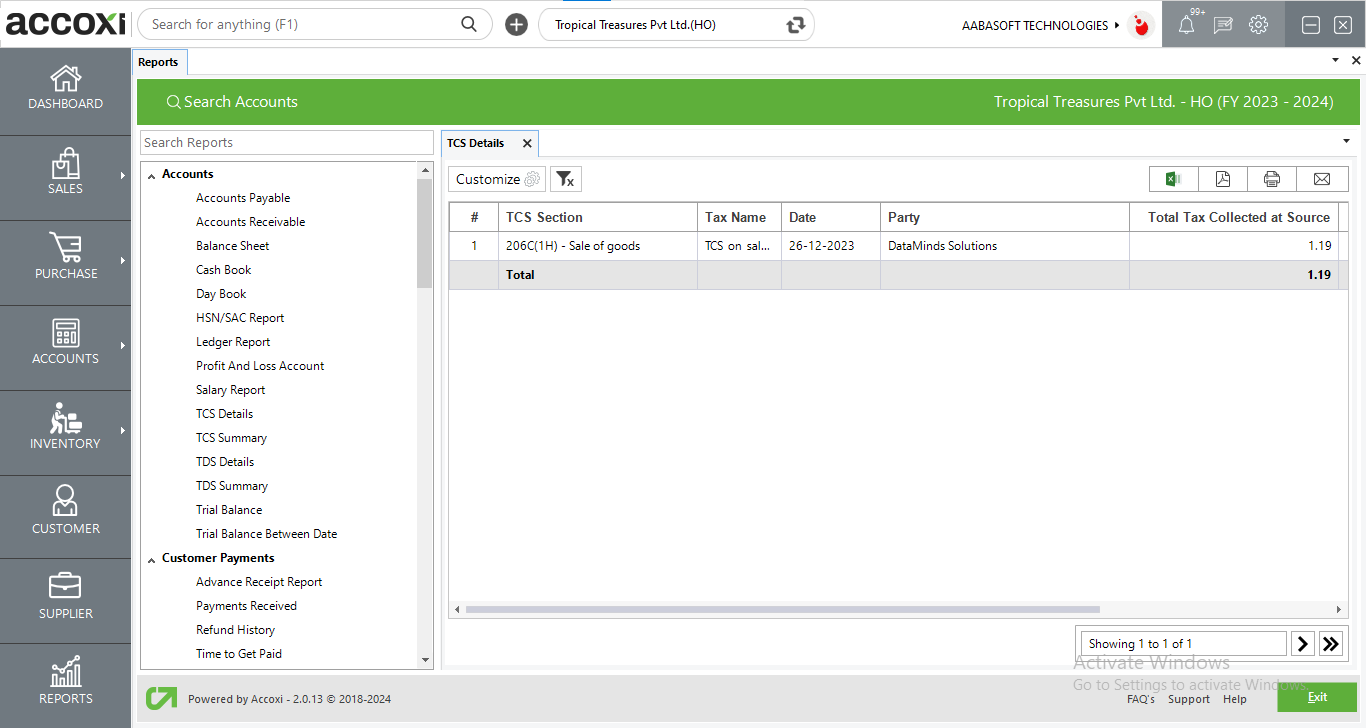

Menu Available in TCS Detail Report

|

Field |

Description |

|

Customize |

The user has the flexibility to tailor the report data by clicking on this button. Data filtration is possible based on date period and TCS section. |

|

Export To Excel |

By clicking this button, users can export the report to excel. |

|

Export To PDF |

Clicking this button allows the user to export the report to pdf. |

|

|

This button enables users to print the TCS detail report. |

|

|

To send the report via email, simply click this button. The report in pdf format will be attached to the email, and you can input the recipient's email address, cc address, subject, and any additional details for the email. |

|

Pagination |

The pagination control offers the capability to navigate from one page to another. |

|

Exit |

Clicking the 'exit' button allows the user to exit from the report. |

Data Available in TCS Detail Report

|

Field |

Description |

|

# |

The Symbol '#' Represents The Number Of Lines In The Given Context. |

|

TCS Section |

This Column Shows The TCS Sections Of The Collected Tax. |

|

Tax Name |

The provided tax name for the applicable section is showing here. |

|

Date |

Date of the transaction is displayed here. |

|

Party |

Party involved in the transaction is showing here. |

|

Total Tax Collected at Source |

Total TCS amount applicable for the transaction is indicated here. |

|

Total After TCS Deduction |

Total invoice amount calculated after considering the TCS amount is showing here. |

|

Total |

Total invoice amount before calculating the TCS amount is showing here. TCS amount is calculated on this amount. |