Here users can get real-time status updates of GSTR-3B returns.

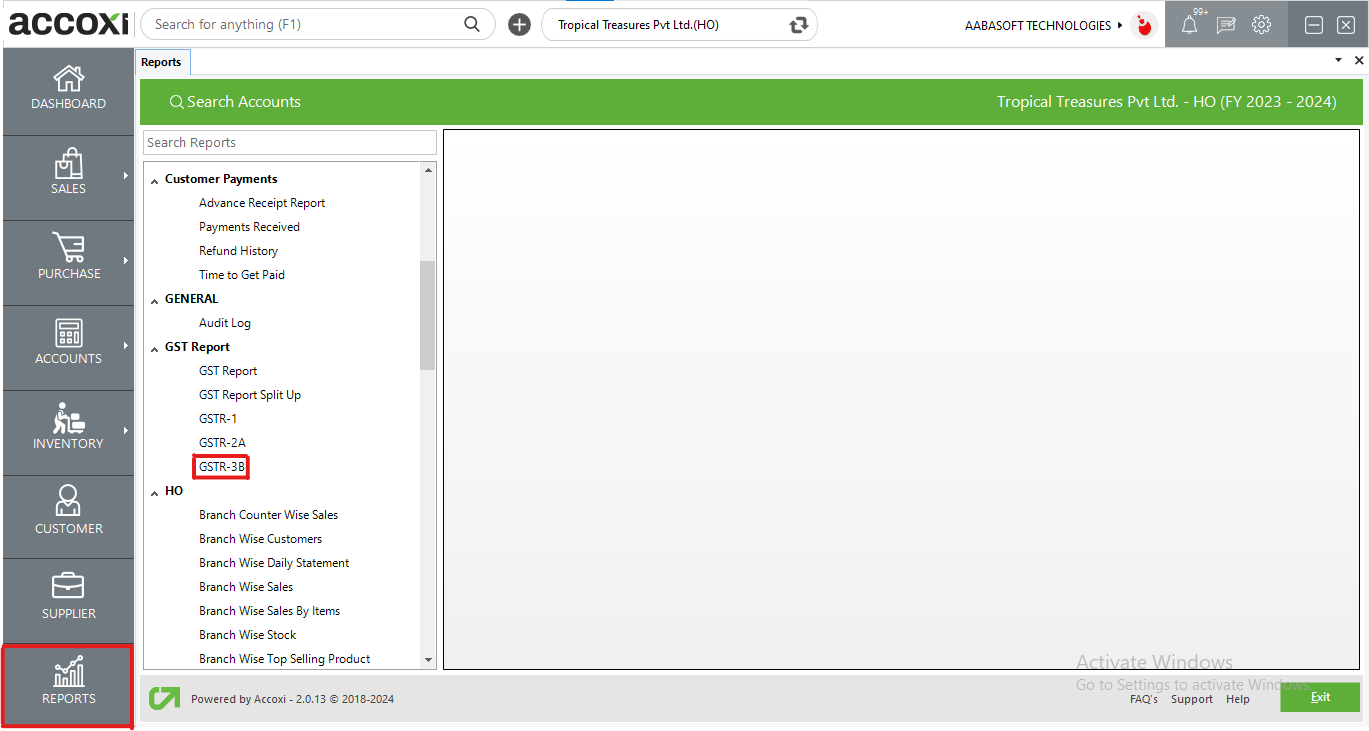

GSTR-3B is a simple summary return that all normal taxpayers must file monthly. In this form, taxpayers summarize and report the total values of purchase and sales without the need to list invoice details. ACCOXI is the most modern accounting software that provides easy and deliberate results for accounting. It provides the module of Reports and it consists of various heads of reports like Payables, Receivables, Accounts, Purchase, sales etc. GSTR-3B Report is available in GST Reports head. ACCOXI provides the monthly GSTR-3B filed report and it gives the data of all GSTR-3B returns of any particular GSTIN. Users can get real-time status updates of GSTR-3B returns and can use the same for comparison with the books of accounts, and the preparation of the annual return. When the user opens the ACCOXI account, the Reports module will appear on the bottom left side of the modules. Click on the Reports module, it opens to various financial reports of the Organization. There are various heads of reports like Payables, Receivables, Accounts, GST Reports, Customer payments, Supplier payments, purchase, sales etc.

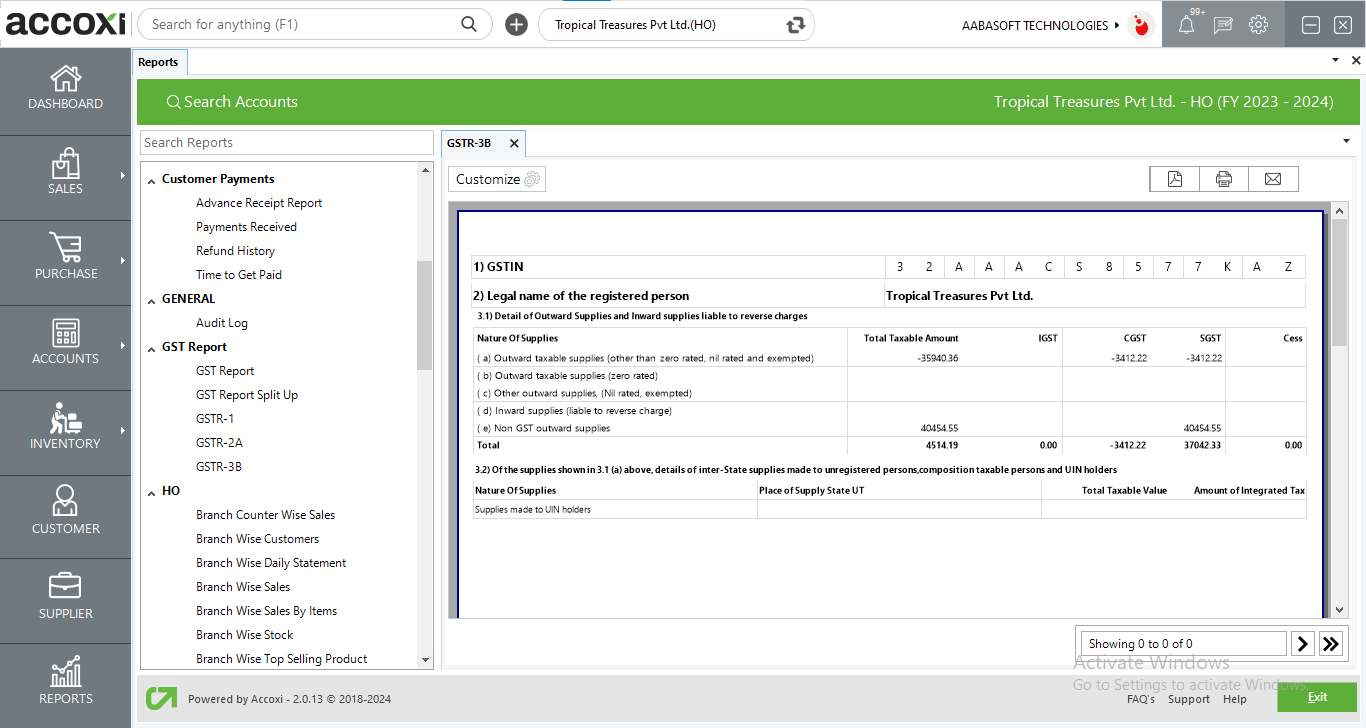

Click on the GST Report head and select the option GSTR-3B. By clicking on the GSTR-3B option, details will popup on the screen.

GSTR-3B

GSTR-3B report helps the user get the filing status of GSTR-3B during a month. The invoice level or summary level information of the filed data is made available for the user’s study.

Menu available in GSTR-3B Report

|

Field |

Description |

|

Customize |

The user has the flexibility to tailor the report data by clicking on this button. Data filtration is possible based on date period. |

|

Export To PDF |

Clicking this button allows the user to export the report to pdf. |

|

|

This button enables users to print the GSTR-3B Report. |

|

|

To send the report via email, simply click this button. The report in pdf format will be attached to the email, and you can input the recipient's email address, cc address, subject, and any additional details for the email. |

|

Pagination |

The pagination control offers the capability to navigate from one page to another. |

|

Exit |

Clicking the 'exit' button allows the user to exit from the report. |

There are different tables and sections included in GSTR-3B. Following are the format of GSTR-3B.

1.GSTIN – It shows the GST number of the registered person.

2.Legal Name of the Registered Person- It shows the Legal name of the registered person.

3.1Details of Outward Supplies and Inward Supplies liable to Reverse charges

Details of Outward supplies and Inward supplies are further broken down in to the following. For each of these provides Total taxable value and further break up into IGST, CGST, SGST/UTGST and CESS if any.

A.Outward taxable supplies (Other than zero rated, exempted or Nil rated);-

It does not include supplies which are zero-rated, or have a nil rate of tax or are exempt from GST. These are provided separately, includes only those supplies on which GST has been charged.

B.Outward taxable supplies (zero rated) –

It includes only those supplies on which GST rate is zero. Zero-rated supplies are exports or supplies made to SEZ.

C.Other Outward supplies (nil rated, exempted);-

Other outward supplies include supplies which are exempt from GST or nil rated. Nil rated supplies are those for which the GST rate is nil and exempted supplies are those which have been exempt from GST.

D.Inward Supplies (liable to reverse charge);-

It includes details of purchase made from unregistered dealers on which reverse charge apply. In such cases user have to prepare an invoice and can pay the applicable GST rate of tax.

E.Non GST outward supplies;-

Non GST outward supplies contains details of any supplies made, kept wholly out of GST.

3.2Of the supplied shown in 3.1 (a) above, details of inter-state supplies made to unregistered persons, composition taxable persons, and UIN holders.

Under this head further break up of outward taxable supplies provided and they are,

4.Eligible ITC

This is the detail required for input tax credit. It provide separately for IGST, CGST, SGST, UTGST and CESS. Only total values are to be reported and invoice level information is not required.

A.ITC Available (Whether in full or part);-

This information be broken down in to ITC on,

B.ITC Reversed

These rules require that input credit reversed for goods and services, where they have been used partly for business and partly for other purposes, to the extent not used for business. Similarly, input credit reversal is also required where supplies include taxable, exempt and nil rated supplies. In the same manner, input credit related to capital goods used for business and other purposes, for taxable, exempt, nil rated supplies also be reversed to the extent not used for business.

Any other Input Tax Credit which has been reversed in the books.

C.Net ITC available (A) – (B) - Net of Available - Reversed ITC

D.Ineligible ITC

1) As per Section 17(5) – Report credit which is ineligible according to Section 17(5).

(2) Others - Any other ineligible ITC.

5.Values of exempt, nil rated and non-GST inward supplies

Here it report any purchases made of goods or services, which are from a composition dealer, are exempt, nil rated or not covered by GST at all. This information be broken down into inter-state and intra-state and it displays the details of nature of supplies.

5.1 Interest and Late fee payable

It shows the details of interest and late fee payable separately for IGST, CGST, SGST, UTGST and CESS.

The GSTR-3B is a simple summary return that all normal taxpayers must file monthly for the nine month period. On this form, tax payers summarize and report the total values of purchase and sales without invoice wise details.

Yes. You can filter the GSTR3B report by using the option Customize Report. It can be done by following steps;