What are the details required to be filled in the GSTR-9?

GSTR 9 is a GST annual return statement that has to be filed by a taxpayer once a year. The statement contains the details regarding all supplies made received under various sections (CGST, SGST, and IGST) in the course of a year in addition to the turnover and audit details for the same.

How to file annual return for GSTR 9?

GSTR 9 A format should be furnished with information about the taxpayer's inward, outward supplies, ITC, tax paid, and other things regarding the tax liability for the year. Let us see how to proceed with the filing of GSTR 9 in detail:

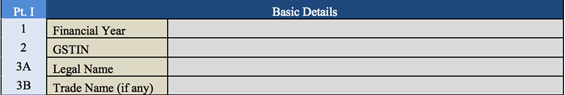

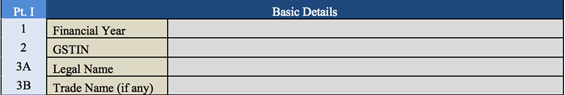

PART 1: Basic details

The first part asks for basic details. financial year, GSTIN, legal name, and trade name (if any)

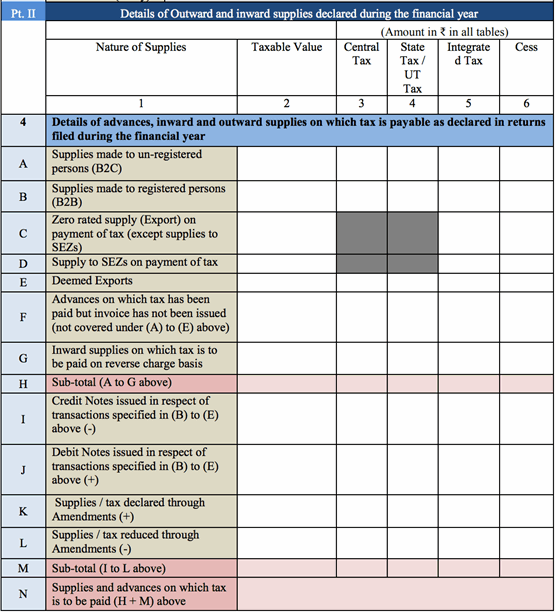

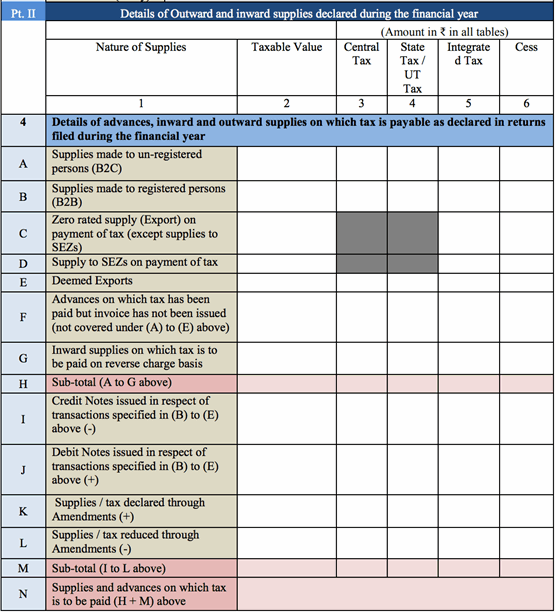

PART 2: Details of Outward and inward supply declared during a financial year.

The second part has two sections to furnish details regarding various types of transactions.

In section 4, you are asked to provide details of advances, purchases, and sales supplies on which the tax is payable. Furnish the taxable value, CGST, SGST, IGST, and cess value for the following.

- A. Supplies to unregistered persons (B2C).

- B. Supplies to registered persons (B2B).

- C. Exported zero-rated supplies for which tax is paid already(except supplies to SEZs).

- D. Supply to SEZs on tax payment.

- E. Deemed exports.

- F. Advances on which tax is paid but the invoice has not been issued (except those which have been provided in the above categories).

- G. Purchase supplies that are liable for reverse charge tax.

- H. The subtotal of the transactions is mentioned in lines A to G above.

- I. Any credit notes that were issued for the transactions given above.

- J. Any debit notes that were issued for the transactions given above.

- K. Supplies or tax declared via any Amendments.

- L. Supplies or tax reduced via any Amendments.

- M. The subtotal of the transactions furnished in lines to L above.

- N. Supplies and advances which are liable for tax from lines H and M, above.

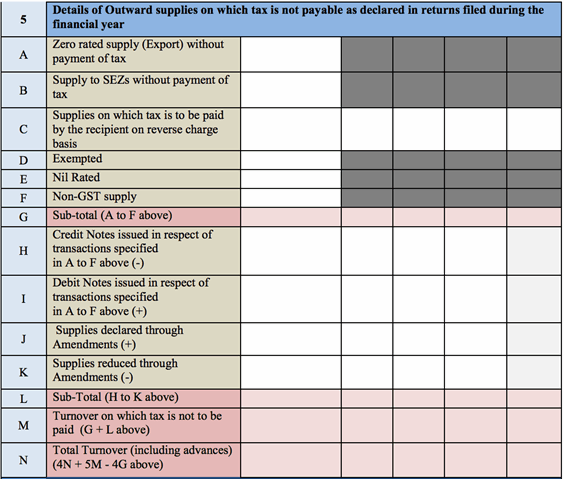

In section 5, the taxpayer is asked for sales supply details for which tax is not payable, as furnished in the returns filed in the financial year. Like in the earlier section, you are required to provide details regarding the taxable value, central and state tax, integrated tax, and cess value for the following :

- A. Exported zero-rated supply without tax payment.

- B. Supplies to SEZs without tax payment.

- C. Supplies for which reverse charge tax has to be paid by the recipient.

- D. Exempted sales supplies.

- E. Nil-rated sales supplies.

- F. Non-GST supply.

- G. The subtotal of the transactions is given in lines A to F above.

- H. Any credit notes that are issued for the transactions given above.

- I. Any debit notes that are issued for the transactions given above.

- J. Supplies declared via any Amendments.

- K. Supplies reduced via any Amendments.

- L. The subtotal of the transactions is provided in lines H to K above.

- M. The turnover amount which is exempt from tax from line G and L above.

- N. The total turnover amount, inclusive of all advances (4N + 5M - 4G above).

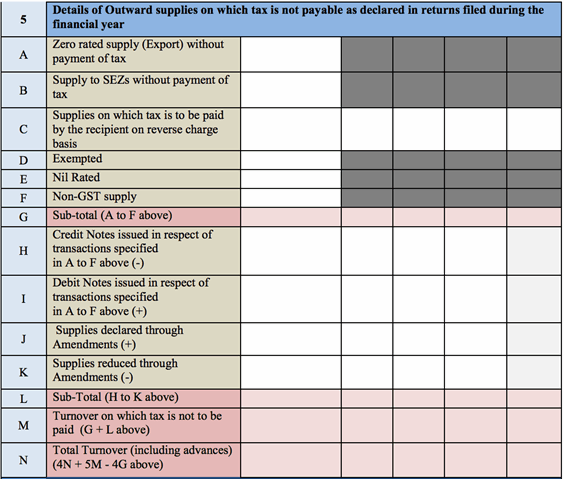

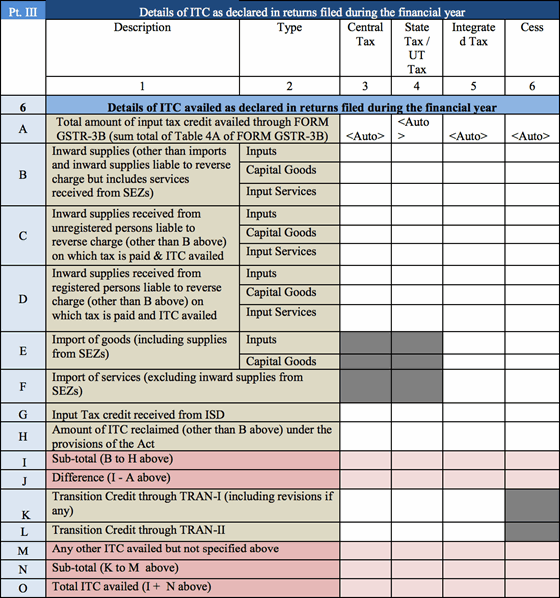

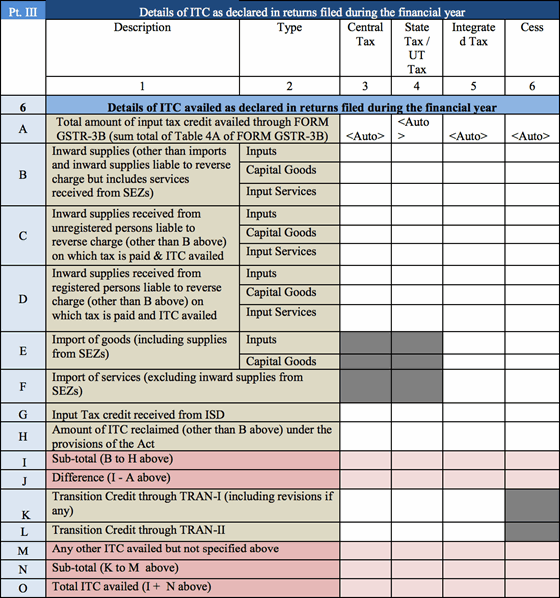

Part 3: ITC Details as declared in the returns filed during the financial year.

Part 3 is divided into 3 questions that seek the details about ITC balance.

In Section 6, you are required to enter details of ITC that you have availed, as declared in the returns filed during the financial year. Fill in the central and state tax, integrated tax, and cess value for the following:

- A. The total amount of ITC availed through GSTR-3B.

- B. The purchase supplies made for inputs, capital goods, and input services (excluding imports and those purchase supplies that are liable to reverse charge, but including services received from SEZs).

- C. The purchase supplies received from unregistered persons for inputs, capital goods, and input services which are liable to reverse charge, for which tax has been paid and ITC has been availed, except those mentioned in line B above.

- D. The purchase supplies received from registered persons for inputs, capital goods, and input services, which are liable to reverse charge, for which tax has been paid and ITC has been availed, except those mentioned in point B above.

- E. The imported goods, including supplies from SEZs, for inputs and capital goods.

- F. The imported services, excluding purchase supplies from SEZs.

- G. ITC that has been received from the ISD.

- H. The amount of ITC reclaimed (besides that mentioned in line B above), under the provisions of the CGST Act.

- I. The subtotal for lines B to H above.

- J. The difference between lines I and A (I - A).

- K. The transition credit mentioned in TRAN-I, along with any revisions.

- L. The transition credit mentioned in TRAN-II.

- M. Any other ITC that has been availed, but not mentioned in any of the lines above.

- N. The subtotal for lines K to M above.

- O. The total ITC availed for lines I and N.

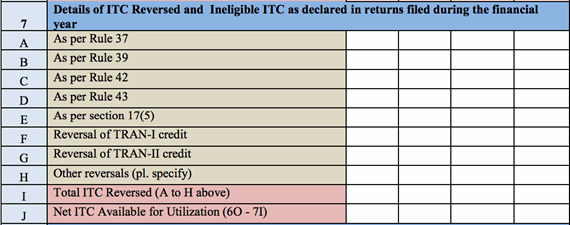

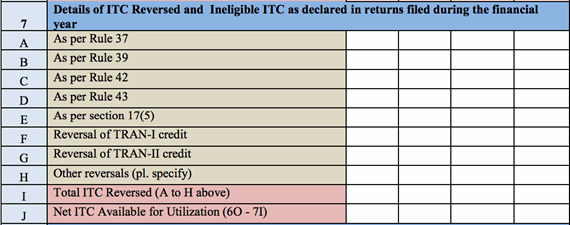

Under section 7, you would be asked to file information with regards to the reversed ITC and ineligible ITC on the central and state tax, integrated tax, and cess value of the following :

- A. In accordance with the reversal of ITC in cases of non-payment of consideration (Rule 37).

- B. According to the procedure for distribution of ITC by the ISD (Rule 39).

- C. In accordance with ITC with respect to inputs or input services and reversal (Rule 42).

- D. In accordance with ITC with respect to capital goods and reversal (Rule 43).

- E. With respect to the blocked credits under GST (Section 17(5)).

- F. The reversal of credit provided in TRAN-I.

- G. The reversal of credit provided in TRAN-II.

- H. Specifications of any other reversals.

- I. The total reversed ITC furnished in lines A to H above.

- J. The net ITC available for utilization (section 6 line O minus section 7 line I)

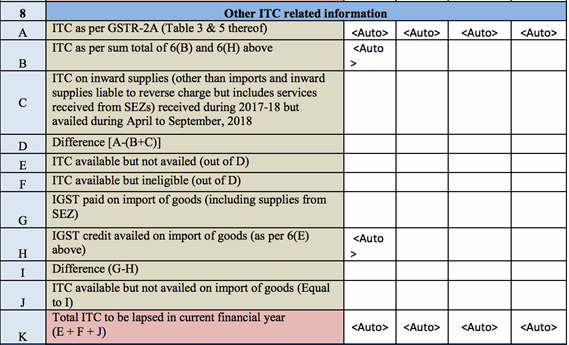

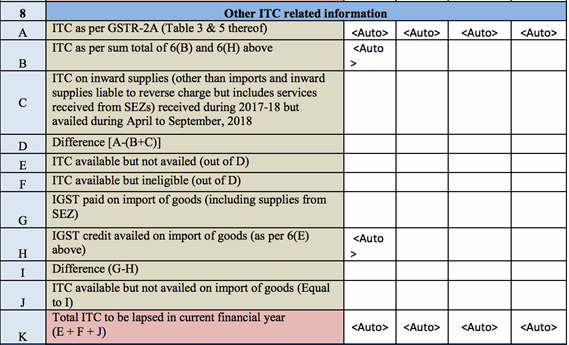

Under section 8, you would be asked to furnish other ITC related information. Fill in the central and state tax, integrated tax, and cess value for the following:

- A. The ITC as furnished in GSTR 2A.

- B. The total sum of ITC is provided in lines 6B and 6H.

- C. The ITC on sales supplies besides imports and inward supplies is liable to reverse charge. Include services received from SEZs during the duration of 2017-2018 but availed between April and September 2018.

- D. Difference between lines A and B plus C. [A - (B + C)]

- E. The ITC that is at disposal, but has not been availed, from line D above.

- F. The ITC that is at disposal, but is ineligible, from line D above.

- G. The IGST paid on import of goods that includes supplies from SEZs.

- H. The IGST credit availed on import of goods, as given earlier in line 6E.

- I. The difference between lines G and H. (G - H)

- J. The ITC is available but not availed on the import of goods (should be equal to the line I).

- K. The total ITC value that has lapsed, or is not valid for the current financial year. (E + F + J).

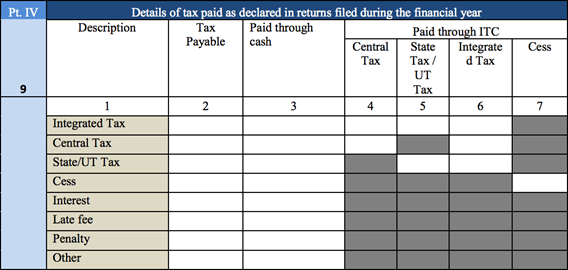

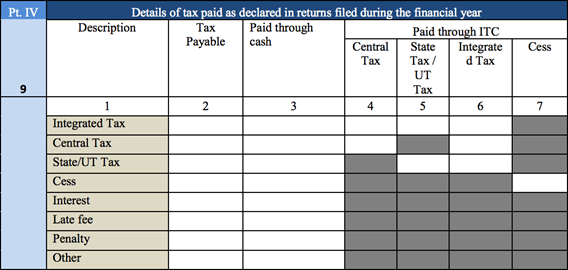

Part 4: Details of tax paid as declared in returns filed during the financial year

Under this part, you can specify all the details with regards to the tax that you paid and declared in returns filed during the financial year.

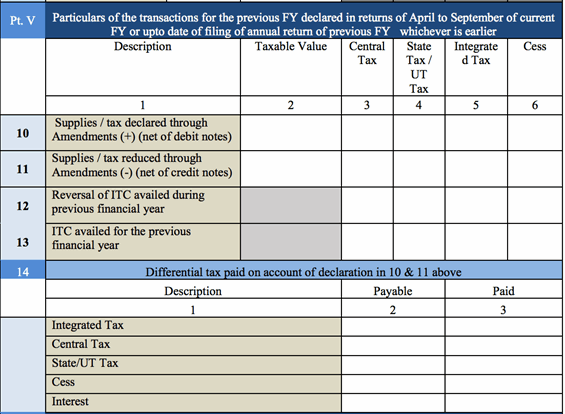

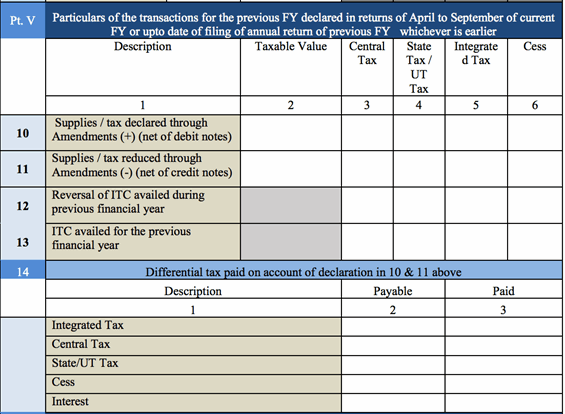

Part 5: Particulars of the transactions for the previous FY declared in returns of April to September of current FY or up to date of filing of annual return of previous FY, whichever is earlier

Under section 10 , you can furnish all the details regarding transactions that were made during the previous financial year. Fill in the taxable value , central and state tax integrated tax , and cess value for the following :

- A. The supplies or tax declared through amendments.

- B. The supplies or tax were reduced through amendments.

- C. The reversal of ITC availed in the course of the previous financial year.

- D. The ITC availed for the previous financial year.

After filling in the above mentioned lines, provide the differential tax payable and paid for the following:

- A. The integrated tax value (IGST).

- B. The central tax value (CGST).

- C. The state (SGST) or UT tax value.

- D. The cess amount.

- E. Interest value.

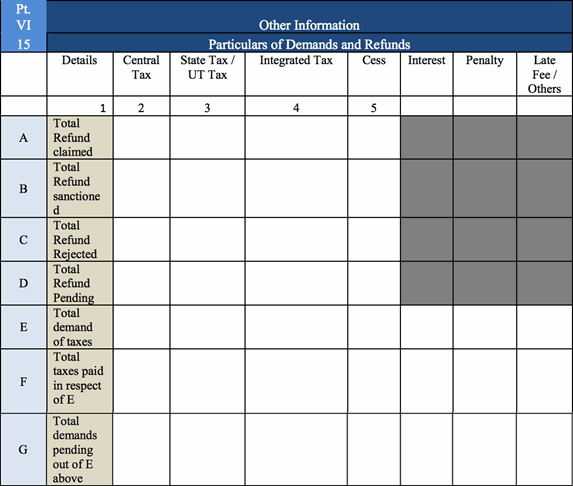

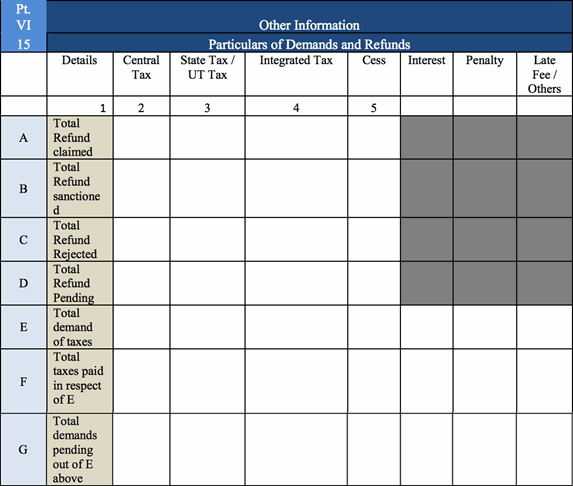

Part 6 : Other information

The final part of the form obtains information that was not given earlier such as demands and refunds , special kinds of supplies , HSN’s & late fees.

Under section 15 , furnish information regarding demands and refunds by filling in the central and state tax , integrated tax , cess value , interest , penalty , and any late fee applicable for the following :

- A. The total refund claimed.

- B. The total refund sanctioned.

- C. The total refund rejected.

- D. The total refund pending.

- E. The total demand of taxes.

- F. The total taxes paid for line E above.

- G. The total demands pending from line E above.

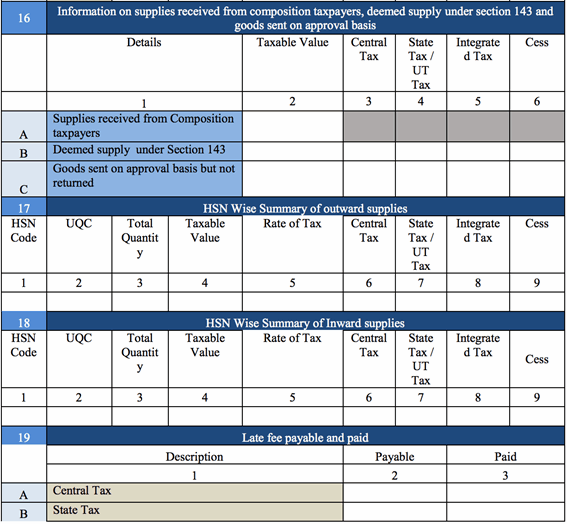

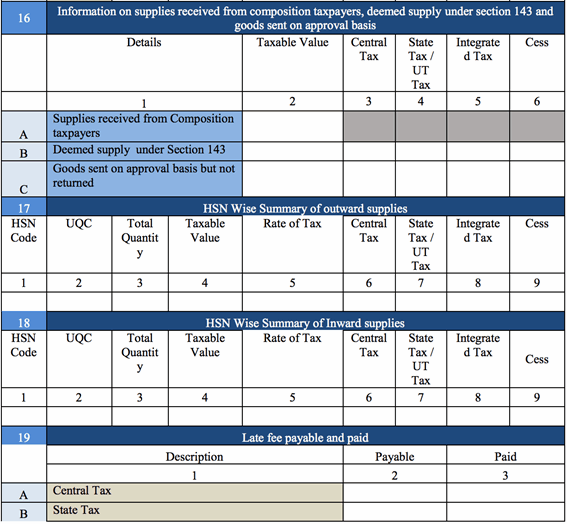

Section 16 is for the information supplies received from composition taxpayers , deemed supplies , and goods sent in an approval manner . Here you have to fill in the taxable value , central , and state tax , integrated tax and cess value for the following : Received supplies from composition taxpayers. Deemed supplies listed as per section 143 . Goods that have been sent on approval manner , but that have not been returned.

Under 17 and 18 sections , that are for listing the HSN wise details for both sales and purchase supplies , in addition to their corresponding tax details and HSN codes.

Under section 19 , that is for payable details and paid late fee regarding central and state taxes.

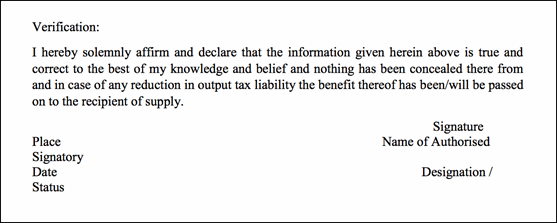

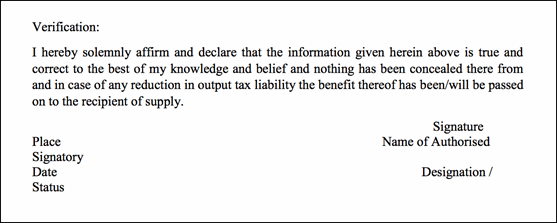

After all the details are provided correctly in the GSTR 9 in accordance with the GST Act and GST rules ,the taxpayer is needed to sign a declaration regarding the authenticity of the information given under different heads by means of the digital signature certificate (DSC) or Aadhar based signature verification.